In 2025, the Hungarian tax system went through a multi-step reform. The tax package adopted under an accelerated procedure on 18 November 2025 aimed to reduce businesses’ tax burdens, cut red tape and continue the digitalisation of tax procedures. According to the legislative justification, the government’s objective is to maintain the competitiveness of the domestic tax environment and to ensure more predictable financial and administrative frameworks for small and medium-sized enterprises as well as for self-employed individuals. At the same time, there are additional changes entering into force in 2026 that Parliament adopted earlier during the year, before the autumn tax package.

Our experts have summarised the most important tax changes for companies and explained their practical implications.

1. Corporate income tax

CIT – New tax incentives

Two new investment-promoting tax incentives were introduced in the 2025 autumn tax package. One is a tax incentive supporting the remediation of environmental damage, which can be claimed for investments with a present value of at least HUF 100 million. The incentive can be applied for six tax years, and a significant share of the investment value—depending on company size, potentially 70–90%—may be deductible. An important condition is that prior notification must be submitted to the designated ministry, and it cannot be used by a business that caused the environmental damage to be remediated.

The other new element is a development tax allowance for investments aimed at ensuring manufacturing capacity for so-called clean technologies, replacing the previous TCTF-based temporary development tax allowance. This CISAF-based tax incentive may be linked to investments that contribute to the green transition (e.g. battery manufacturing, solar panels, heat pumps, CO₂ capture technologies). The allowance may be claimed up to 80% of the calculated tax, and it is subject to ministerial notification (and, in Budapest above EUR 150 million, outside Budapest above EUR 350 million of aid, to approval by the European Commission).

Overall, both incentives create substantial opportunities for tax savings; however, due to the complexity of the rules, it is advisable to model the tax impacts of investments in advance and align them with other forms of support. In a large-corporate environment, additional factors—such as the global minimum tax—may also influence the actual effect of the incentives, therefore multinational groups should carry out comprehensive planning in advance.

2. Value added tax (VAT)

Increase of the turnover threshold for VAT exemption

The change affecting VAT exemption aims to reduce the administrative burden for micro-enterprises. The higher threshold is expected to significantly improve the liquidity of sole proprietors and small businesses, as fewer transactions will fall within the scope of VAT and the VAT return filing obligation will be reduced.

The VAT exemption threshold will be increased gradually, in three steps over several years:

| 1 January 2026 | HUF 20 million |

|---|---|

| 1 January 2027 | HUF 22 million |

| 1 January 2028 | HUF 24 million |

A taxpayer may opt for VAT exemption for 2026 if the cumulative annual amount of consideration received or receivable for all domestic supplies of goods and services does not exceed HUF 20 million in 2025 (actually), nor is it reasonably expected to exceed it in 2026, nor does it actually exceed it in 2026.

New mandatory fields in the “M sheets

In the recapitulative statement attached to VAT returns for the tax assessment period that includes 1 July 2026, data will have to be reported not only on the VAT charged on invoices, but also on the VAT deducted (input VAT placed in deduction).

Online receipt data reporting

Mandatory receipt data reporting will enter into force on 1 September 2026. For manually issued receipts, data will have to be reported within 3 days, aggregated daily and broken down by tax rates. For e-receipts and documents treated as receipts issued via an e-cash register, as well as invoices and documents treated as invoices, reporting must be made to the tax authority simultaneously with issuance (this has applied since July 2025).

Real-time Online Invoice Reporting (RTIR) Calculator 2026

3. Personal income tax (PIT)

Family tax benefits

The PIT exemption for mothers of three children entered into force on 1 October 2025, and from 1 January 2026 the tax base allowance per dependent will increase further. For one child, the monthly tax base reduction will rise from the current HUF 100,000 to HUF 133,340; for two children, the allowance will be double that amount; while for three and each additional dependent it will be HUF 440,000. The monthly amount of the family allowance will also increase to HUF 133,340 for dependants who are chronically ill or severely disabled.

The PIT exemption for mothers raising two children will also be introduced gradually: in the first step, from

2026 mothers under 40 will be exempt, and from 2027 the exemption will also extend to those aged 40–50. Based on the adopted legislative text, the exemption becomes complete across all age groups from 2029.

Favourable changes for flat-rate taxpayers

A key element of the autumn tax package is the reduction of the tax burden of flat-rate taxed sole proprietors. The expense ratio for sole proprietors applying the 40% expense ratio will increase in two steps:

- from 1 January 2026 to 45%,

- from 1 January 2027 to 50%.

In practice, this means that the affected entrepreneurs—primarily service providers—may recognise a larger portion of their revenue as costs, thereby reducing the PIT base and resulting in direct tax savings.

The amendment mainly benefits those operating with a low cost ratio and whose activity typically relies on their own labour/knowledge. For them, the higher expense ratio makes flat-rate taxation significantly more competitive and, in many cases, it may become more favourable than taxation based on entrepreneurial income. Entrepreneurs may want to carry out an impact assessment in advance, as increasing the expense ratio may also affect expected advance tax payments.

4. Social contribution tax (Szocho)

Change for full-time individual and corporate entrepreneurs

From 1 January 2026, the currently applied 112.5% multiplier will be abolished, which defined the social contribution tax base of full-time individual entrepreneurs and corporate entrepreneurs compared to the social security contribution base. Under the amendment, the Szocho base will be at least 100% of the minimum wage or the guaranteed minimum wage.

The advantage of the change is that calculating the payable public burden becomes more transparent, and for many entrepreneurs the monthly amount payable may decrease.

In addition, from 2026 not only flat-rate taxed sole proprietors, but also sole proprietors applying taxation based on entrepreneurial income will have to submit a declaration of their social contribution tax liability quarterly.

- Accordingly, the Act on the Rules of Taxation (Art.) will be amended, eliminating the distinction between sole proprietors opting for different taxation methods.

- In the quarterly return, the payable public burden must be indicated in a monthly breakdown.

- The Szocho payable for the quarter must be paid by the same deadline as the return filing deadline, i.e. by the 12th day of the month following the quarter concerned.

5. Small business tax (KIVA)

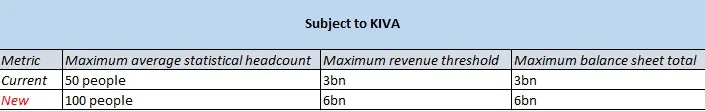

The thresholds entitling taxpayers to opt for KIVA will increase from 1 December 2025, so that from 1 January 2026 taxpayers can choose KIVA based on the higher thresholds.

Based on current data, many companies are already above the previous HUF 3 billion level, but still do not reach the HUF 6 billion revenue and balance sheet total thresholds or the 50-employee headcount limit, so for them a realistic opportunity to opt for KIVA may now open up for the first time. In addition, due to changes in headcount and other indicators, further businesses may enter the regime that previously dropped out due to marginal exceedances.

It is important that anyone wishing to choose this taxation method from 2026 must do so by year-end.

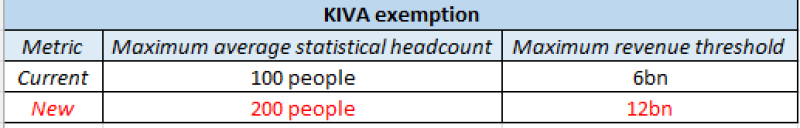

Increasing the exit threshold to HUF 12 billion means that businesses that successfully grow can remain within the KIVA regime longer, making the structure more planable not only as an entry point but also as a long-term tax strategy.

Another change in the KIVA Act is that one component of the tax base related to personnel-type payments will be amended. Under the current rule, for members / full-time corporate entrepreneurs the personnel-type expenditure attributable to the member is 112.5% of the minimum wage if the member’s personnel-type expenditure is lower than that. Under the amendment, from 2026—in line with the change to the Szocho Act—the amount of the minimum wage will form the KIVA base in such cases.

6. Sectoral taxes and other “extra profit” taxes

Retail sectoral tax – new brackets, differentiated impacts

Another key element of the autumn tax package is that the tax brackets of the retail tax will change. The lowest bracket will be completely reshaped: instead of HUF 500 million, the tax payment threshold will be HUF 1 billion, so several thousand small businesses may be exempt from paying the retail tax.

| Tax | Current bracket | Amended bracket |

| 0% | HUF 0 – 500m | HUF 0-1bn |

| 0,15% | HUF 500m – 30mrd | HUF 1bn-50bn |

| 1% | HUF 30bn – 100bn | HUF 50bn-150bn |

| 4,5% | above HUF 100bn | above HUF 150bn |

The new brackets may not only ease the burden for the smallest players: shifting the lower bracket and adjusting the higher steps may result in a broader reduction of the tax burden primarily in the SME segment, and the burdens of the largest retail chains and platform operators may also decrease significantly, as the highest rate will only be payable above HUF 150 billion, instead of above HUF 100 billion.

What should taxpayers watch out for due to the changes in the retail sectoral tax?

- From the definition of retail activity, the sale of services at fuel filling stations will be removed.

- The July and October advance payments may result in overpayment due to the new, higher brackets.

- The overpayment can already be reclaimed in 2025 using a separate form, at the latest by year-end.

- If the expected and actual tax base differs, this can be settled in the annual return.

Banking sectoral tax

From 2026, the rate of the special bank tax will increase to 8% for the portion of the tax base not exceeding HUF 20 billion, and to 20% for the portion above HUF 20 billion, replacing the previous rates of 7% and 18%, respectively.

7. Advertisement tax

The advertisement tax rate has been 0% since 1 July 2019, which the Government has extended year by year. However, contrary to previous practice, the 2025 autumn legislative package extended the applicability of the 0% rate only until 30 June 2026, meaning that the advertisement tax will be reintroduced from the second half of 2026.

In line with the reintroduction, the registration rules relating to advertisement tax will also change. Anyone publishing advertisements who does not have a Hungarian tax number—typically foreign advertising publishers—will be required to register within 30 days. Failure to do so may result in a significant penalty burden. Significant penalties may also be imposed for failure to provide mandatory statements.

8. Excise duty

Indexation of excise duty on fuels postponed

The inflation-linked increase of excise duty will enter into force six months later, therefore the expected price increase of petrol and diesel will be temporarily avoided. This change may be favourable for businesses sensitive to logistics and freight costs.

9. Tax administration and the rules of taxation

Changes in administration

The tax package aims not only to reduce business burdens but also to modernise tax administration and procedural rules.

Automated decision-making and digital procedures

The amendment of Act CLI of 2017 (Air.) stipulates that the tax authority may conduct procedures using automated decision-making where the conditions—under Act CIII of 2023 on state digital services (Dáptv.)—are met, all relevant data are available and no discretionary assessment is required. This step serves to make tax authority procedures faster and more predictable; however, the substantive review function of legal remedies remains unchanged.

Digitalisation of enforcement procedures

The amendment of Act CLIII of 2017 (Avt.) allows minutes taken during on-site procedures to be prepared in electronic form and served electronically. This change improves the documentability and transparency of enforcement procedures.

Fine-tuning of the Act on the Rules of Taxation (Art.)

Act CL of 2017 (Art.) will be amended in several respects: for example, in the case of suspension of a sole proprietor’s activity, the obligation to file a return for the period not covered by the annual return will cease if the suspension covers the entire period. In addition, NAV access to real estate registry data will become possible electronically, and terminological clean-ups of legal concepts will be carried out.

10. Income tax of energy suppliers (“Robin Hood tax”)

Tax rate

The rate of the income tax of energy suppliers will decrease in 2026 from the 41% rate applicable in 2025 to the previously effective 31% rate.

Tax allowance for energy development investments

For energy development investments started after 31 December 2025, businesses will be able to claim a new, targeted tax allowance from 2026. The aim of the scheme is to incentivise the modernisation of production and infrastructure energy systems, with a particular focus on efficiency-improving and environmentally conscious developments.

The allowance can be applied in the tax year in which the investment is put into operation and in the following five tax years, i.e. it can be used for a total of six tax years (base year + 5 years).

The upper limit of the allowance consists of several steps:

- the allowance may be deducted up to 80% of the calculated tax reduced by other tax allowances, i.e. it cannot reduce the tax payable to zero;

- the amount of the allowance may not exceed 50% of the difference between the eligible costs of the investment and the adjusted depreciation.

Eligible costs include the acquisition cost of tangible assets and intangible assets related to the investment, reduced by any non-repayable grants received for the project. This means the allowance can effectively be taken into account only in respect of the company’s own expenditures.

Eligibility conditions include:

- meeting specified professional indicators for the investment, and

- continuous use of the relevant assets for at least five years.

An important compliance element is that NAV will mandatorily check the conditions within three years from the first claim of the allowance; therefore, keeping records of documentation and performance indicators related to the investments becomes particularly important.

Applying the allowance can result in a meaningful reduction of the tax burden; however, due to the complexity of the rules and the mandatory tax authority audit, it is advisable to carry out preliminary financial and tax planning calculations.

Key considerations for businesses

The legislative amendments entering into force from 2026 create several new opportunities, but they also require well-considered and informed decision-making:

- The impact of tax incentives and taxation regimes varies by type of business.

- The KIVA regime is most advantageous where wage costs represent a high proportion of total expenses or where local business tax liability is significant under the general rules; in other cases, it may not necessarily be the optimal choice.

- The benefits of VAT exemption are sector-specific: businesses relying heavily on investments or the procurement of services may even be disadvantaged.

- Making effective use of investment tax allowances requires careful tax planning and expertise in assessing state aid content.

- Due to the increasing digitalisation of tax procedures, it is also advisable to review internal administrative and documentation processes.