The FY2025 year-end period is a particularly demanding time for most businesses: several reporting and tax compliance tasks as well as statutory deadlines have to be considered in financial and tax areas. During this time, it is easy to overlook a relatively new obligation in connection with which several companies have not created a stable year-end routine yet. However, failure to comply with the global minimum tax (Pillar II) notification obligation for FY2025 may entail significant risks and substantial penalties. It is therefore worth consciously preparing for the deadline of 28th February 2026 in case of calendar-year taxpayers.

The global minimum tax notification obligation: not a one-off task

It is important to emphasize that the notification related to the global minimum tax is not a one-off administrative step. Although the affected businesses have already completed the first notification for the FY2024 (which had to be submitted by 31 December 2024), based on the Hungarian rules the notification must be repeated annually, the deadline of which is 28 February 2026 for taxpayers having a tax year identical to the calendar-year.

We would also like to highlight that the notification obligation does not arise solely for businesses subject to top-up tax payment liability. The notification obligation is connected to falling under the scope of the GloBE rules and may therefore also apply to businesses that ultimately do not have any payment obligation for various reasons.

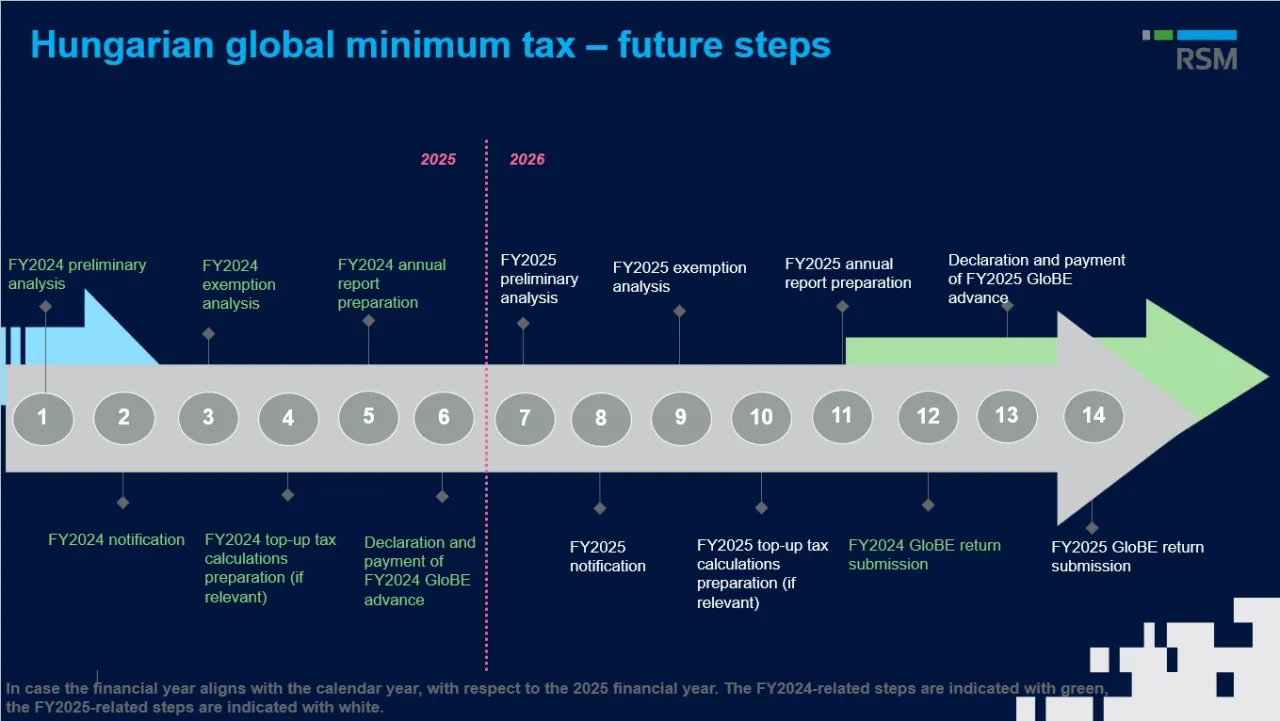

Main tasks related to GloBE – indicative timeline in case of calendar-year taxpayers

Failure to comply with the global minimum tax notification obligation: HUF 5 million penalty and tax audit risk

Failure to comply with the GloBE notification obligation is not merely a formal deficiency: the tax authority may impose a penalty of up to HUF 5 million, unless the group member has acted with due care as could reasonably be expected in the given circumstances. In addition, issues may also arise where the notification is submitted on time but contains inaccuracies, for example, if an incorrect top-up tax type is selected on the notification form, which may subsequently give rise to correction obligations and increase the risk of a tax audit.

The key to the correct completion of the notification form: preparing preliminary analysis to assess whether a company subject to Pillar II rules as well as QDMTT / IIR / UTPR tax types

Prior to submitting the notification form, it is advisable to carry out a preliminary analysis, within which it should be assessed - among others - whether the group falls within the scope of the GloBE rules for FY2025, and which type of top-up tax (QDMTT, IIR, UTPR) applies to the Hungarian group members in Hungary.

Given that the rules state that the data from the preceding four financial years has to be considered, the outcome of the analysis - and consequently the content of the notification form - may change from year to year. As a result, a business that was previously not affected may fall within the scope of the global minimum tax, while a company previously within scope may fall outside it. For this reason, carrying out the preliminary analysis cannot be omitted for any tax year. Furthermore, as of FY2025 all three types of top-up tax are applicable in Hungary, as such, determining the correct taxpayer status is of even greater importance. This requires a clear calculation and proper documentation underlying whether a given group member falls within the scope of a specific top-up tax or not.

Global minimum tax at year-end closing period: how to incorporate the fulfillment of notification obligation into the annual routine?

In light of the above, the preliminary analysis and notification related to GloBE should be treated as an integral part of the year-end closing process and as a recurring annual task, rather than as a one-off project. Performing the analysis in a timely manner not only constitutes to the statutory compliance but also helps to avoid unnecessary risks and penalties during an already demanding year-end period.

Furthermore, the reviews and analyses carried out at this stage will form the basis for the global minimum tax tasks in the coming months. Based on the top-up tax status as determined within the preliminary notification, it will be possible to assess whether any GloBE exemptions may be applied. In the absence of such exemptions, the exact GloBE tax liability has to be calculated and the corresponding tax amount has to be indicated in the FY2025 annual report as well.