Our experienced tax consultants assist our clients (corporate groups) to calculate the global minimum tax liability, investigate potential exemptions, mitigate tax risks and develop the optimal tax strategy.

The purpose of global minimum tax

The global minimum tax, developed by the OECD and implemented into EU law, aims to ensure that the effective tax burden for groups of companies with a revenue above €750 million is evenly distributed among group members and that the effective tax rate per country reaches 15%.

Global minimum tax: entities concerned

In enacting countries, the global minimum tax will apply to multinational enterprise groups and to members of large-scale domestic corporate groups of companies operating in EU member states, provided that, as a general rule, the group's consolidated revenue is equal to or exceeds €750 million in at least two of the four tax years preceding the tax year in question.

Global minimum tax - interpretation of complex legislation and a significant administrative burden for companies

The global minimum tax rules* bring significant changes and new challenges to many corporate groups. Global minimum taxation requires complex calculations, comprehensive legal knowledge and precise administration. An experienced tax consultant can assist you calculate the global minimum tax liability, investigate potential exemptions, mitigate tax risks and develop the optimal tax strategy.

RSM services in the field of global minimum tax:

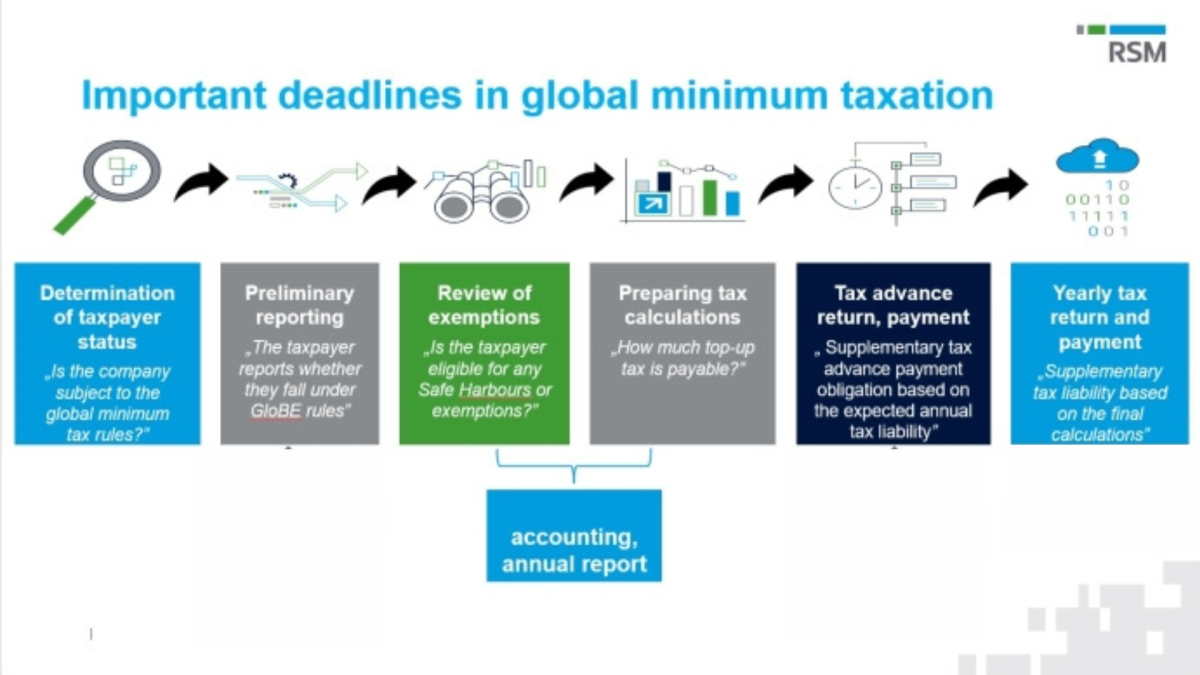

- Determination of global minimum taxpayer status: Analysis if the company(group) falls under the scope of the global minimum tax law and discovering the related Hungarian tax obligations;

- Administrative assistance relating to global minimum tax: assistance in notification, data reporting obligations;

- Overview of potential exemption options from global minimum tax, analysis of the applicability of transitional or permanent safe harbour or other exemptions;

- Services related to the calculation and reporting of supplementary taxes according to the Global Minimum Tax Act, assistance in calculations for the purposes of year-end closing, annual report preparation and statutory audit;

- Finalization of global minimum tax calculations based on the final figures and compliance assistance in the relating tax advance and annual tax return preparation tasks.

Our experts are available to our clients with comprehensive and up-to-date international and domestic tax law knowledge in connection with the fulfillment of global minimum tax obligations.

*Act LXXXIV of 2023 on Top-Up Taxes Ensuring a Global Minimum Level of Taxation and on the Amendment of Certain Related Tax Laws