By mid-2025, the European M&A environment had become far more stable and orderly compared to previous years. Although deal activity did not surge dramatically, it is clearly evident that investors have returned to a consistent, long-term sustainable strategic approach. Despite geopolitical, political and macroeconomic uncertainties, the M&A environment continues to demonstrate strong adaptability—also confirmed by the steadily increasing number of transactions up to June 2025.

Between 2024 and June 2025, RSM’s advisory team supported 731 completed transactions across Europe, indicating that the market has been operating in a stable and consistent manner rather than in a volatile one. Activity throughout the year shows that both investors and corporates have been able to maintain momentum, and based on the outlook for 2026, targeted, value-driven deals are expected to remain dominant.

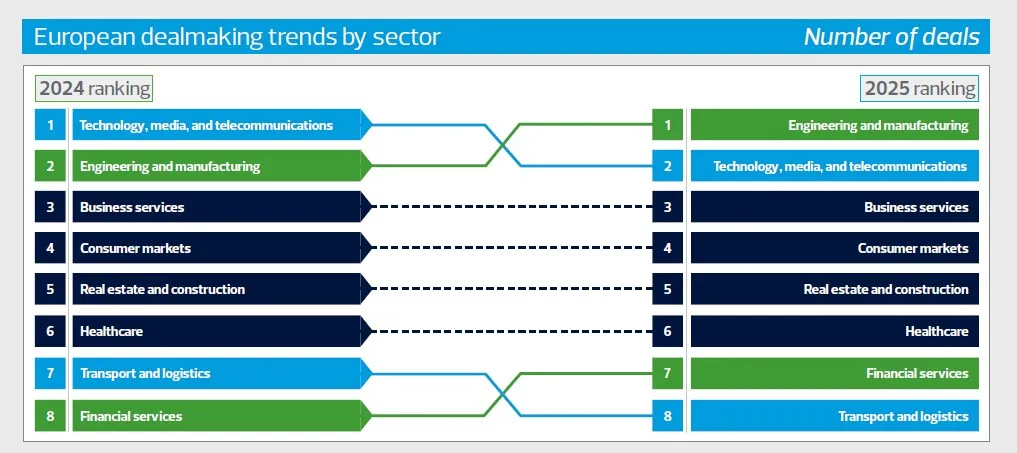

Most active M&A sectors (June 2024–June 2025, RSM Europe)

- Machinery and manufacturing: 147 deals

- Technology, media and telecommunications: 139 deals

- Business services: 135 deals

In these segments, demand remains resilient, strategic drivers are strong, and investors are keen to target companies where a solid technology foundation, a predictable revenue model and scalability come together.

Macroeconomic backdrop: interest rates, inflation, FX and fiscal risks

In 2025, the economic environment was noticeably calmer than in prior years. The European M&A market continues to operate cautiously. According to the IMF’s October report, the continent’s economic performance may improve by 1–1.5% in the medium term. The 16.3% import tariff affecting exports to the US market and the 7.1% appreciation in the nominal effective euro exchange rate (NEER) may challenge the competitiveness of some highly export-oriented sectors (most notably manufacturing and high-tech).

The interest-rate environment has stabilised significantly since 2024. The ECB cut policy rates by a total of 200 basis points, while long-term government bond yields in several countries stagnated or even increased moderately. As a result, volatility in financing and discount rates has eased, allowing for more predictable WACC modelling and pricing.

Inflation has normalised in the euro area, hovering around 2%. In contrast, in the CESEE region (including Hungary), the price level has remained 1–3 percentage points above target, resulting in higher government bond yields and risk premia. Investors have partly priced this in: according to the IMF, European debt ratios could rise as high as 130% by 2040, making fiscal credibility increasingly important going forward.

The role of Private Equity: more disciplined strategies, buy-and-build focus

Private Equity has remained active in M&A in recent periods, with a large share of the 731 completed deals across Europe attributable to this segment. According to Bain’s 2025 report, global buyout deal value increased by 37% in 2024, and by 54% in Europe, confirming a strong PE presence. Investment strategies have become more disciplined, and PE players are focusing on safer deals, heavily relying on buy-and-build models and the consistently abundant pool of European mid-market targets.

What to expect in 2026 in the European M&A market?

In 2026, the European M&A market is expected to be characterised by lively but selective activity. Investors are specifically targeting sectors where meaningful growth prospects are visible.

The energy transition, AI-based business models and healthcare services are likely to remain in strong focus. While geopolitical and regulatory question marks will persist, the number of cross-border deals may still increase—especially in more loosely regulated, technology-oriented segments.

Sector overview 2025–2026

Machinery and manufacturing

In machinery and manufacturing, 147 successful transactions were completed across RSM Europe between June 2024 and June 2025. Demand remained strong for engineering services, healthcare-use technologies, specialised manufacturing, and solutions linked to the energy transition. Private Equity is particularly active, as specialised, high value-added companies are performing well. The sector is expected to remain lively in 2026 as well, especially in technology-focused areas.

Technology, Media & Telecommunications (TMT)

The TMT sector largely maintained its momentum in 2025, with 139 deals completed across RSM Europe. The market continues to be driven by stable subscription models and digital transformation. Significant interest focused on AI-based solutions, cybersecurity, vertical SaaS models, infrastructure and IT services. As financing is not cheap, many deals are structured—through earn-outs or hybrid financing. A pickup is expected in 2026, particularly in AI-oriented areas.

Business services

In business services, RSM supported 135 deals across Europe. The mid-market remains exceptionally strong, driven by sustained demand for scalable service models with recurring revenues. The most active areas include professional services, staffing, and TICC (testing, inspection, certification). PE interest is at a historical high. Further consolidation and increased activity are expected in 2026.

Consumer products

In the consumer segment, 91 completed European transactions characterised the 12-month RSM period. The market has become far more selective: buyers are looking for premium, exportable branded products. The strongest interest has been seen in food brands, wellness, sports and household products. PE players are more cautious here. Cash conversion is weak for many companies, therefore due diligence is longer and more detailed. In 2026, moderate but predictable activity is expected.

Real estate

In real estate, 84 deals were completed across RSM Europe. For example, institutional investor activity was outstanding in the Czech and Polish markets. The gradual stabilisation of EU interest rates supports deal appetite, although residential development remains slow in several countries. Commercial real estate, hotels, logistics and student housing are among the hottest areas. Cautious optimism is expected in 2026.

Healthcare

In healthcare, 73 transactions were successfully completed across RSM Europe. The sector enjoys steadily growing investor interest, reinforced by macro trends such as ageing societies and the rise of digital healthcare solutions. Focus has shifted toward eHealth, pharma services, dental, injection-based and outpatient clinics. PE is actively building platforms, particularly around AI- and automation-driven models. Cross-border transactions are also increasing. In 2026, stable, innovation-led growth is expected.

Financial services

In the financial sector, 34 deals reached closing stage, with the focus still on wealth management, asset managers and the independent financial advisory segment. There is significant movement among larger players managing tens of billions of dollars in assets. Regulation is tightening, which may turn smaller players into acquisition targets. For 2026, a cautious but positive outlook is emerging.

Transport and logistics

In transport and logistics, sellers and buyers reached agreement in 28 deals. Despite multiple challenges, the sector remains resilient: the energy-efficient green transition of fleets requires substantial capital, encouraging partnerships and consolidation. Routing and fleet software, efficient transport technologies, EV charging infrastructure and specialised logistics providers have gained importance. In 2026, gradual improvement is expected, driven by technological and sustainability needs.

M&A 2026: targeted, value-driven deals may continue to dominate

Overall, the European M&A environment in 2025 became more stable, while investor focus is increasingly shifting toward quality, scalability and predictable cash flows.

Based on the 2026 outlook, a more active but still selective market is likely, where technology, the energy transition and healthcare may play a key role—and Private Equity buy-and-build strategies may further strengthen mid-market activity.

Sources

- RSM (2025) European M&A Market: 2025 Trends and Growth Drivers. RSM International.

- International Monetary Fund (2024) Europe and CEE Regional Economic Outlook. IMF, Washington, D.C.

- Invest Europe (2025) Investing in Europe: Private Equity Activity H1 2025 – Statistics on Fundraising, Investments & Divestments. Invest Europe Research, Brussels.

- Bain & Company (2025) Global Private Equity Report 2025. Bain & Company, Boston.